Growth Lies Ahead; Here Are Some Key Drivers:

Consumers: Rising incomes and inflation-adjusted savings balances will help boost Retail Sales rise in the years ahead. Higher-income earners and those who saw their home prices rise and stock portfolios increase in value in recent years will likely drive much of the growth. Those demographics struggling with inflation should get some relief in 2025, but price sensitivity will linger. Retail Sales growth will start out sluggish in early 2025 but then ramp up later in the year. Improving consumer metrics will also be a positive for other sectors ranging from manufacturing to services.

Interest Rates: The Federal Reserve has shifted to a more accommodative monetary policy; however, a lower Federal Funds Rate does not necessarily equate to lower interest rates for businesses. Commercial loans and mortgage rates trend similarly to US Government Long Term Bond Yields, which we anticipate will have a relatively flat trajectory with the potential for minor downward movement into mid-2025. Beyond rates, borrowing conditions are improving. Many lenders have stopped tightening their credit standards, and the default risk premium has moved lower, suggesting lenders are less concerned about recession risks – though there are lingering concerns specific to the CRE market. When deciding on capex, focus on timing the ROI to best align with your market trends as opposed to waiting for a low in rates. Aim to have the payback period completed ahead of the 2030s, as we anticipate tougher economic times in that decade.

Inflation: Prices will generally rise in 2025 and 2026, picking up the pace in the second half of 2025. Inflation will be temperate relative to levels of 2021 and 2022 but not as low as in the 2010s. If further tariffs are put in place, they could pose an upside risk to our pricing outlooks.

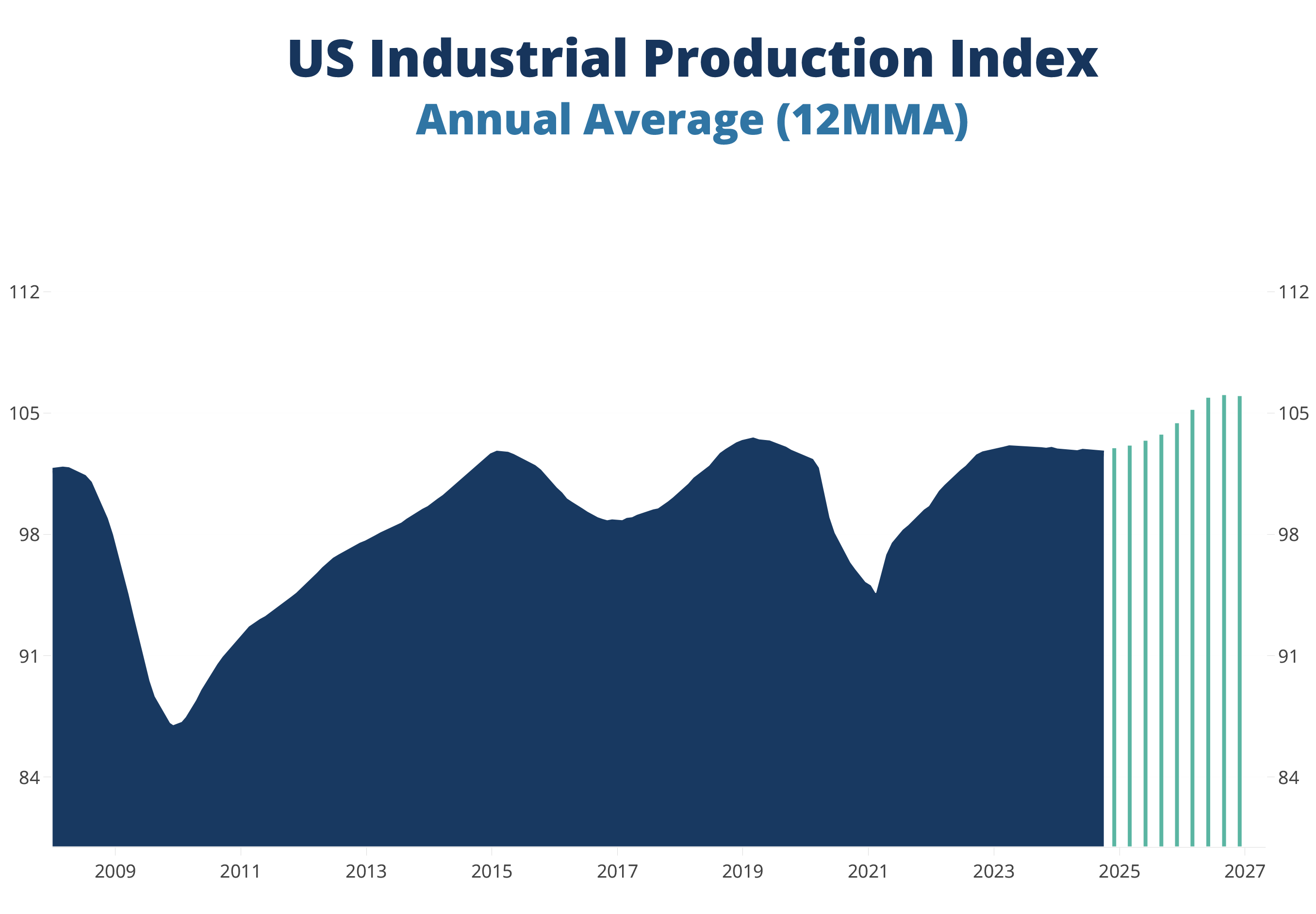

Businesses: While borrowing costs may not come down much more, elevated corporate profits and corporate cash will allow businesses to spend more. We expect investments in domestic capacity in recent years to have a cumulative positive effect, helping the economy reach record heights. Rise will be driven both by higher volumes and higher dollar values. Efficiency gains will be necessary to maintain or improve margins.

The Labor Market: Labor challenges will persist in the upcoming years, as will the upward pressure on wages. While the labor market has softened, it will remain relatively tight in the coming years due in part to the aging population. It will be important to focus resources on attracting and retaining talent in the coming years. Keep your wages and benefits competitive for your region and industry.

Key Industries and Takeaways for Your Business

It may feel difficult to be optimistic at this point in the business cycle, but there are green shoots. Leading indicators, including the ITR Leading Indicator™, point to upcoming business cycle rise; however, markets will trend differently throughout this period. In the construction market, residential construction will rise for much of the next few years, despite affordability constraints, given the high demand for housing. The nonresidential construction sector lags the overall economy and is likely to undergo mild decline for much of 2025 and into 2026. There will be areas of opportunity within nonresidential construction, notably data centers, as they are in high demand and likely to rise in the coming two years. Within the industrial sector (which will be boosted generally by the nearshoring efforts of the past few years), manufacturing related to technology will likely be an area of opportunity.

What is your business doing to prepare for macroeconomic rise in 2025 and 2026? Do you have the capacity needed to take on more activity, or can you harness new technologies to increase productivity? Rising prices coupled with lingering price sensitivity could cause margin squeeze. Now is the time to focus on efficiencies to protect your margins and increase flexibility. If possible, diversify your supply chain or move inputs for your US consumer base closer to the US to help insulate you from potential future trade conflicts. Think back to previous periods of business cycle rise: What do you wish you could have done differently, and what worked well? Remember that for most markets rise will be more muted this cycle than during the pandemic stimulus-boosted rise.