Economic Overview

Where is the economy headed in the coming quarters? Many segments of the economy will experience mild to moderate growth in 2026, but do not expect a blockbuster year unless you have material exposure to an upside outlier, such as AI and data centers. Here are some trends to keep an eye on.

Consumer: Consumers are spending more than ever and are generally in a good spot, with record-high employment, rising inflation-adjusted incomes, and room to take on more debt. There is certainly some discomfort and price sensitivity. Those in lower-income brackets are seeing more and more of their expenditures squeezed by housing, food, and health care. Nonetheless, the majority of expenditures are made by consumers in middle- to upper-income brackets, a group that is well positioned to keep spending. We anticipate that US Total Retail Sales will generally rise in the coming quarters, though the pace will be muted relative to recent years.

Businesses: US Small Business Optimism is rebounding, and corporate balance sheets indicate a capacity to spend. Leading indicators point to modest gains in US Nondefense Capital Goods New Orders, our preferred benchmark for B2B spending, over the next two years. We anticipate increased investment in capital goods as firms adjust to elevated borrowing costs and policy uncertainty eases. Tariffs and a tight labor market underscore the need to invest in efficiency.

Inflation: Growing demand for goods and services will amplify inflationary pressures, the seeds of which were already planted with prior monetary and fiscal policy. Commodity prices are volatile and are more likely to swing with changing trade conditions and economic uncertainty; however, on net, both producers and consumers need to prepare for further rising prices. Companies need to be proactive in guarding against “profitless prosperity.” Rising prices will put pressure on margins, making it crucial to focus on efficiency, differentiation, and effective marketing.

Interest Rates: The Federal Reserve will likely cut the overnight rate in its mid-September meeting, but the economic fundamentals suggest limited justification for material rate cuts over the next year. The 10-Year Treasury Yields are typically a better proxy for actual borrowing costs in the economy and are typically “stickier” than the overnight rate. Long-term rates will vacillate around the current level in the near term and potentially dip slightly, but we anticipate a general rise beginning in mid-2026. If you need to borrow or roll over debt in the next few years, plan for your interest expenses to go up. If you are counting on interest rates to suddenly drop and be a cure-all for economic pain points, you may be disappointed.

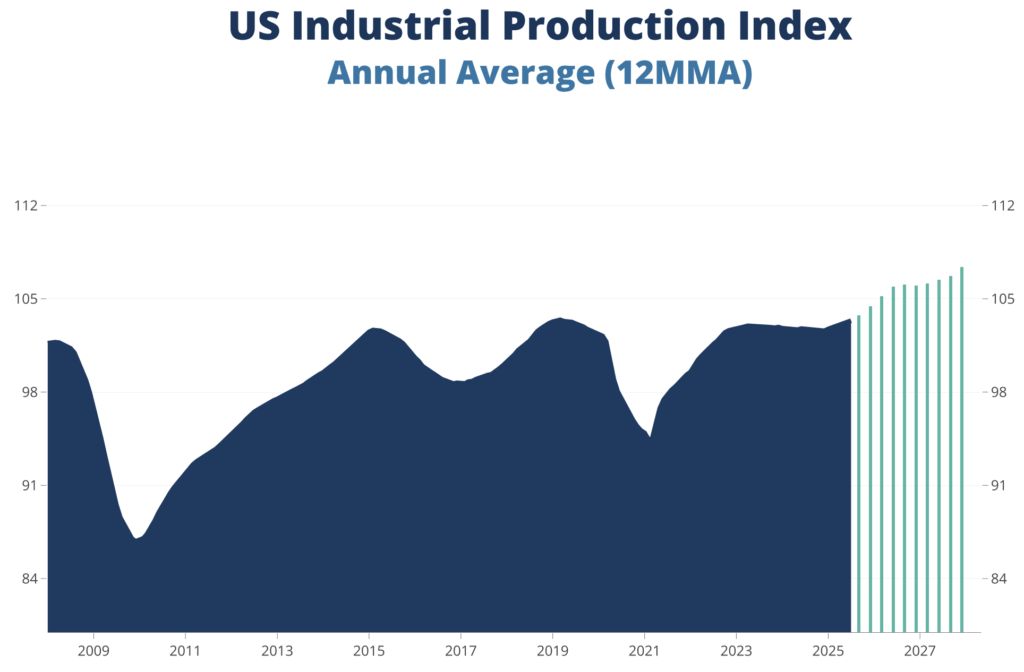

Industrial Sector: With businesses and consumers both in good positions to spend, there will be upward pressure on the US industrial sector. Investments in domestic capacity made in recent years will help enable higher levels of production. The industrial sector will generally rise, but leading indicators signal that this rise could be choppy.

Construction: Single-Unit Housing Starts, which lead the economy, are declining largely due to trends in the South, as affordability constraints persist. Businesses tied to regional housing should closely monitor local activity. We expect near-term recovery, but it is likely to be muted rather than robust. Multi-Unit Housing Starts are generally rising, with permits suggesting more growth ahead. Nonresidential construction is contracting, but areas of opportunity, including data centers and some public segments, remain.

Takeaways

The biggest bang for your buck this cycle will be to focus on improving your company efficiencies. We are anticipating a modest rise in demand. Top-line growth is likely to outpace bottom-line growth as the pricing environment puts margins under pressure. Efficiencies, including automations to help your business rely less on labor, and working to eliminate bottlenecks will help your business capture upcoming growth.