Just before the 2008 financial crisis, Author Nassim Nicholas Taleb published a book that described rare and unpredictable events with severe economic consequences. He referred to these events as Black Swans.

Few could predict the enormous scale and resulting impact COVID19 has had on nearly all aspects of our lives. The new prediction for infections from the U.S. Administration is startling, to say the least. To all reading this, please be safe and follow the recommendations from health professionals. Nevertheless, we have companies to run, employees to pay and customers to serve.

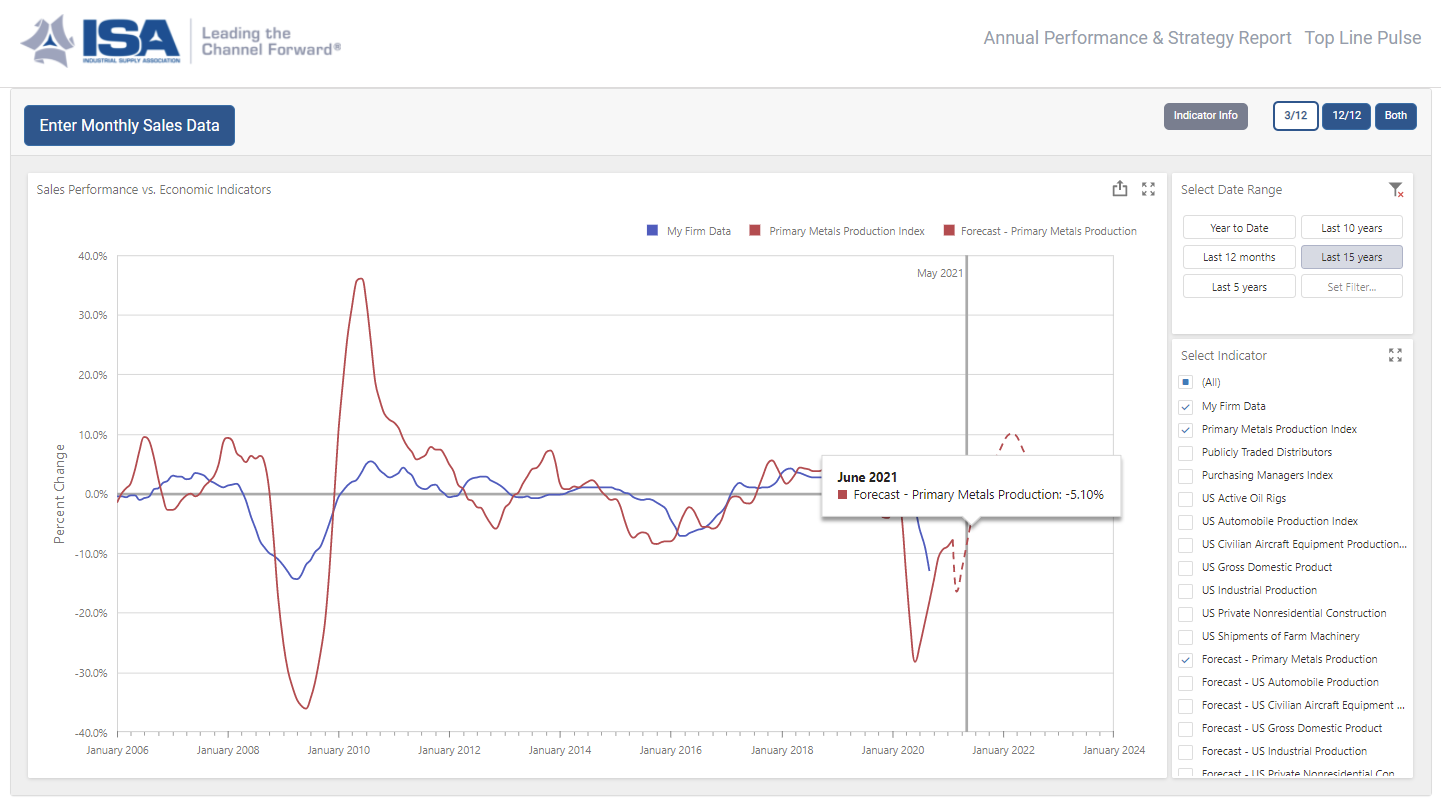

In this quarter’s ISA Advisor, published exclusively for ISA members, economists provide an industry-specific update to their forecasting models given the unprecedented March we have all had. They also note that we are not only experiencing one Black Swan. In early March an oil price war began between Saudi Arabia and Russia causing the price per barrel to continue to free fall. The ripple effect of this war continues to cause volatility in the world financial markets and is sending American shale producers reeling.

These two events have a direct impact on our channel. The government restrictions and health recommendations aimed at mitigating the spread of the novel coronavirus are wreaking havoc on ISA Member companies’ ability to staff their warehouses and factory floors, get their sales teams in front of their customers and deliver their product to end-users. The oil crisis is also causing panic for those directly selling into the energy sector, causing financial markets to react wildly and risk tolerances to lower. This is our reality today.

Taleb went on to characterize Black Swans by the way observers obsess about how these events come to be, who is at fault and how they could be avoided. As the leaders of our businesses, we should instead be focused on what tomorrow looks like or two months or two years from now.

In the previous ISA Advisor, economists predicted a rebound in U.S. Industrial Production for mid-year 2020 requiring more capacity in the channel to meet increased demand. These Black Swan events have not changed their outlook as it relates to the forecasting of a rebound… just the timing. They are now forecasting the U.S. Markets to come back up in late 2020 or early 2021 and, along with it, demand in U.S. Industrial Production. Your business will need to be ready.

So, how can we move forward and prepare for the new normal?

The Point –

Don’t panic!

Drawing down your sales force or laying-off line workers to keep your business afloat could be a short-sighted approach depending on the health of your business pre-March. Recognizing that not all companies have the ability to access new sources of cash to keep the lights on and avoid layoffs, yet some are doing just that to preserve their company’s future. Grainger just announced this week that they will access $1B from its revolving credit facility to strengthen its cash position. If your business is on the smaller side, consider the new SBA programs rolled out as part of the $2T U.S. relief package. Do what you can to keep your business running so that when the business comes back in a couple of quarters, you are ready.

Consider the impossible

Black swans are not predictable and are devastating to many businesses. But now that we are going through one (or two), what could we have done in our business to better prepare? Was your business able to flex to a work from home policy? Is your shop floor designed with social distancing in mind? Are you mainly sourcing from overseas? Is your company reliant on a just-in-time inventory management model?

These questions don’t make any of us feel good about what is happening today but right now we do have the opportunity to document the challenges we are currently facing and build a contingency plan for a pandemic such as this. We never thought this pandemic would happen like this. If this happens again, it’s up to us to be better prepared. Black swans, while rare, will happen again.

Consider the new normal

This is an excellent time to dive inward and consider your company’s overall strategy. Ask the questions that challenge the core of your business, its purpose statement and the way you make your money. With chaos comes opportunity. With so many companies shifting their strategies and customer needs changing to adjust to the new normal, consider how your company can position itself ahead of the curve.

The advice given here is not without the understanding that a lot of businesses must make some very tough decisions including layoffs, restructuring or ultimately closing their doors. Black swan events like these are transformative. After this is all over, things will be different for everyone. Some companies will be gone. Others will just barely survive. But some others will emerge stronger and more focused on the future. Which company do you want to be?